If you have critical problem with budget in Victoria 3 you could raise taxes or you could setup consumption taxes on specific goods. In my today article I will look more to this taxes and I will provide you tips how to use consumption tax properly.

Setting consumption tax best practices

If you need to boost your budget you could setup consumption tax. You could use “consumption tax” button in detail of any good or you could open income view and click on “consumption taxes” where you could select taxes which you need.

You could setup this tax on every good which is in game and is available to your poops. This tax pays just your poops so setting this taxes doesn’t affects prices for factories. Every consumption tax cost authority because this is because it’s some kind of intervention into your country.

And every consumption tax cost different authority based on how much essential goods are. On image bellow you could see that taxes on “luxury furniture” cost only 75 authority. This is because we are talking about luxury goods but if we look on “grain” we could see that this tax cost 375 authority…

… also this authority shows you how many problems will you have if you set this taxes. For example if you set consumption tax on grain there will be probably more pops “angry” at you because you will increase prices of main goods which they use.

How I use consumption taxes?

These taxes I use only in early phases of Victoria 3. I’m usually using these taxes on “luxury good” when I need to boost income and I don’t want to totally upset my poops. With these taxes I focus to get a money which I use to boost my construction sector…

… because when I have big and strong construction sector I could run construction faster and my GDP will grow significantly faster than the GDP of neighbouring countries. And so I can quickly get to a self-sustaining level to build an economically strong country and after that I turn consumption taxes off.

On images above you could see how many additive income I could have if I use this taxes. But I don’t need it because in middle and late game phases I’m focusing on higher standards of living. And bigger taxes aren’t good for big standards of livings. So as I mention I’m using consumption taxes to boost construction.

Is good to use consumption taxes in Victoria 3?

In long-term I don’t recommend you using this consumption taxes. Is good have lover taxes in your country. Because when you have lover taxes then will grow “buying power” of your pops. If buying power grows than more people of your nation will be richer and this will be reflected in the overall prosperity of the country.

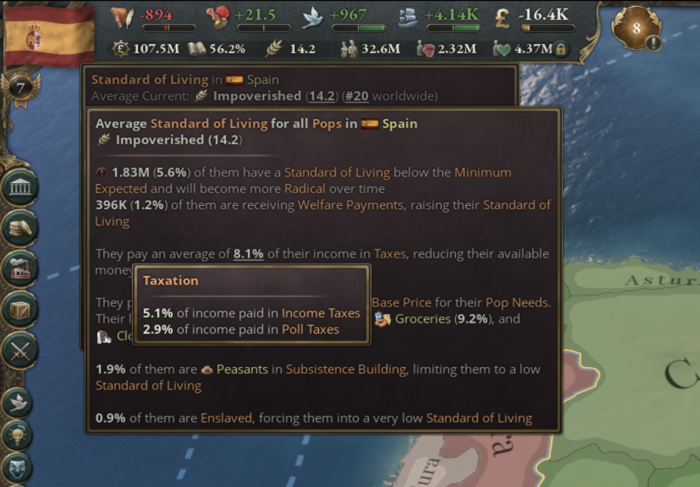

How affects consumption taxes standard of living

Bellow you could see that “taxes” are one of metrics which is used in SOL metrics. So will be good lovering taxes to boost your economy as I mention above.

Also you could see taxes detailed in population screen. Also you could see how much taxes every group pays. If you need to increase consumption taxes you could look on this screen. And watch which part of your population doesn’t have big taxes and you could increase consumption taxes for this part of population. Bellow you could see that “upper strata” doesn’t have big taxes se there you could start.