After I started to understand the economic side of Victoria 3, I also started to focus on the other details of the game. I have to say that (at least from the US perspective) I came across some very interesting tips. Today, I’d like to introduce you to how to make a lot of money in Victoria 3.

If you are not interested in theory and want to know how to make more money in Victoria 3, click on 💰 in the table of headings below and you will get right to the tips. If you are interested in theory and want to learn how the economy works in Victoria 3, then keep reading.

This article follows the experience I described in my previous articles on GDP, standards of living, construction and tips to start a new game. I recommend you start with them and come back to this article. But it is not a requirement.

Basic theory about money in Victoria 3

If we talk about money and your treasury in this game, the basic rules of economics from the real world apply here as well. Your country has income on one side and expenses on the other. In case you manage to keep the income higher than the expenses, you practically win.

To succeed you need a strong economy and a well-functioning market. Sometimes it’s detailed micro-management that can be seen quite complex but that’s the beauty of it. The game tries to simulate a real economy so you have revenue from taxes, currency release or trade management.

On the other side, you have a budget that you have to constantly meet. If you have a dysfunctional economy, then your industry will need to be supported significantly more, and that will mean more spending for you.

To succeed, you have to watch what the game gives you for information. Most things are presented intuitively and if you don’t know something, you can always view the help section which explains practically everything. You just have to read and evaluate everything carefully. Follow the charts that the game gives you and remember what you changed and how it helped.

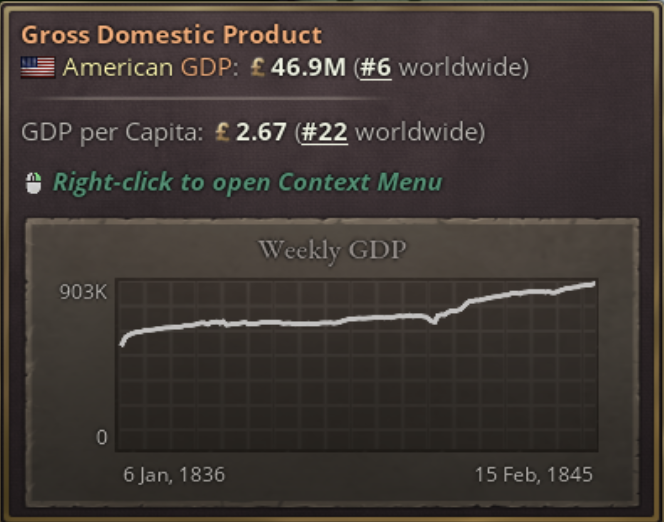

If you take everything I teach you in this article and apply it in practice, you will see the kind of economic growth I see today. In the first 10 years of playing, I went from 30M GDP to 47M GDP which is a growth of 56% in 10 years so about 5.6% growth of GDP per year. It’s a pity that this graph can’t be compared with the graphs of others states, it would certainly show interesting information.

This article was written while I was playing. I definitely didn’t follow everything I’ve written yet because I’m continually discovering and adding to the tips. However, the overall output will be even better.

How to analyze your income and expenses?

The money tab is something you want to keep track of on an ongoing basis. You should know why the number presented to you in the top bar is going up or going down. In case there is a big jump in it, you should immediately go analyze the reason why is it rising or falling.

I marked in orange the main numbers you want to track, which when you hover your mouse over, it will quickly show you via a graph whether their income/output is increasing or decreasing.

You want to know all the information indicators that are hidden under each item. That’s why I have here a quick explanation that should help you to find your way around:

➕ National Revenues

- Income taxes = Taxes paid from buildings

- Poll taxes = Taxes from every working pop

- Tariffs = Taxes from trade

- Minting = Revenue from new money deployed to economy

- Diplomatic Pacts = Revenue from diplomatic pacts

➕ Temporary National Revenues

- Investment pool = Bonuses from interest groups

➖ Fixed National Expenses

- Goods for government buildings = Paper or other goods which government needs

- Government wages = Wages for people working for government

- Goods for military buildings = Goods used in military buildings

- Military wages = Wages for people working in army

- Subsidies = Wages for people working in subsidies

- Diplomatic pacts = Bankroll and other diplomatic costs

- Interest = Interest paid on the loan if you go into deficit

➖ Temporary National Expenses

- Construction Goods = Price for goods used for buildings

💰 Tips to make money in Victoria 3

Work with cash reserves

Each state has its own Gold Reserves, which is the maximum amount of money you can have in your treasury to work with. This limit can be increased through research and working with interest groups. But be cautious, you can never have more money than the limit in your treasury.

The opposite are Credit Limits which are the maximum debt you can get into with your country. The maximum amount of “debt” is determined by the cash reserves that each building in your state has and also by some fixed amount you get for the amount of your GDP.

All information can be found in Budget > Assets.

You may ask why I mention this as the first tip. It is that if you have a lot of money in your coffers, especially if you are approaching the max, you shouldn’t be afraid and you should invest the money you have into your economy. For example, you can support building more or put the money into buying obligations.

But beware, if you get into a deficit, you will have to pay interest on the amount owed, which will rise as the debt increases. So if you have a lot of money, invest it. If you have debt, make it a priority to pay it off because until it is paid off, the money will keep disappearing.

Optimize your construction sector

Your biggest expense (if you are not at war) will be the construction sector. You have to pay for raw materials and so it makes sense to invest in making those inputs cheaper. Because the following equation is true:

lower price of input raw materials => lower costs => you save money

So you have to keep an eye on the construction sector and work actively with it. The more you build, the more revenue opportunities you create. On the other hand, if you do not work well with it, you will not use the full potential of construction and therefore your GDP will grow slowly.

I have written a more detailed article on what raw materials are consumed by levels, in which you can also find a cost calculator. If you have a shortage of resources, your buildings will be expensive and this will lead to you losing money.

If you want to increase your building speed, you can go into a temporary deficit, however, if you have an expensive raw good, your new construction buildings will have to focus on increasing the income of that expensive raw material.

Subsidies of expensive items

In addition to the Construction sector, you must also pay for other sectors including Government and Military. In both cases, these are expenses that you want to keep to a minimum. The Government sector needs to pay primarily for the maintenance of government buildings and the goods they consume.

I recommend you build only those buildings that you immediately need. And with the same approach, work with the goods that these buildings need. Paper supply is essential to have a functioning Government Administration and Clippers are needed to have enough trade routes.

At the same time be careful because these raw materials are important to you. Do not trade them with another country. Build your own factories/workshops for these goods so you always have enough.

Similar to Government Buildings, the same principle is applied to Military Buildings. Again you pay for each building you build so you also pay for the weapons/ships that these buildings will need for continuous arming.

It is therefore necessary that you have a robust arms industry that will supply these buildings and thanks to which the price of these goods will go down. Again, I do not recommend buying army goods from foreign countries. In the event of a potential war, there could be a problem with an embargo being placed on you and you won’t be able to trade much in these goods. This would lead to an increase in price which you as a country would have to subsidize heavily. This would cost you a lot of money.

If you don’t supply enough raw materials, you cause “shortages” which lead to economic collapses or production shutdowns. Primarily, however, this happens in conventional buildings where production stops almost immediately and people are laid off. You want to avoid this as well.

Optimizing trading routes

Another way to save money is through trade routes. The game shows you “unproductive trade routes” that cost you more money in tariffs than they generate. It might make sense to cancel these routes so you don’t have unnecessary expenses.

But before you do, hold on. Some of the goods you supply through the market will reduce the price of the goods in your market. In my case, you can see I subsidized the supply of iron from foreign countries. But on the other hand, if I didn’t import those raw materials, the price would go up and I would have to pay more for the construction, and it’s a question of what would do to the overall cost. Therefore, unless I actually have a surplus of a given raw material and I know that the raw material is important to me, I try to maintain these trade routes.

So not every trade road is bad even if it loses. You can justify it by making a profit on something else. At the same time, I check from time to time whether I have some significantly cheap raw materials so I can offer them to the market. It can somehow lead to a raise in my market’s price which can eventually lead to buildings being more efficient and earning more >> i.e. the economy runs better.

Keep an eye on Tax Waste

I didn’t follow Bureaucracy the whole time in my last game, and as you can see, it’s in the negative. When I took a look at what problems I’m having, I found that I have +13.8% tax waste due to corruption or lack of people. I’m collecting significantly less in taxes than I eventually could.

The way out of this is simple. You need to increase your 📝 Bureaucracy by building more Government Administration in places where you have enough staff. Or by switching the way your Government Administration works.

As you can see above, there are several ways to solve it. In my case, I lowered the Tax Waste percentage a bit (from 14% to 10%) and my total tax income went up by about 5%. You definitely want to check this number while you are solving tax problems.

Use the investment pool

While solving the problem above, I tried to solve through using the “I’ll build a lot of Government Administration” whatever it takes approach. Suddenly, I ended up in an even bigger income deficit than I was before the whole event…

…in the picture below can be seen how it went down. I had a full government queue and my income had gotten worse…

…so I had been researching what my income had been reduced to. And I had noticed a new item I hadn’t considered before, and that was the investment pool. As you can see, I could fund various types of construction through the pool, but I couldn’t fund the Government Administration.

So when I decided to change my priorities and prioritize some of the buildings they write about, suddenly my income was higher and there was an entry in the income side of the budget called “Investment Pool Transfer” which helped me to finance the construction of new industrial buildings.

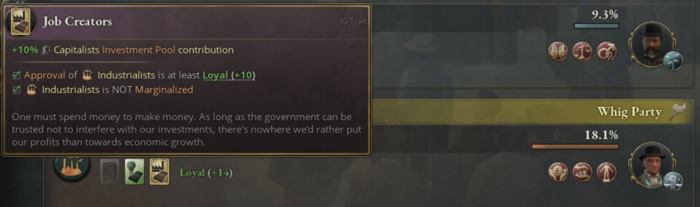

Where this investment pool comes from and how to generate it is simple – you just have to find which political party generates the bonus income for the investment pool. In this case, the members of the “industrialists” give me 10% of their income for development. And that’s why I don’t want to piss off this party.

Use Bankroll carefully

We all want to acquire some country’s obligations – I fully understand you, but this too can be played with a bit more sense. Moreover, you can make an economic profit from it all. Unless you have a +40 relationship with the target country it’s not worth it to improve relations with that country for money. That’s why the first thing to do is to improve relations economically.

Every country has a limit of acceptance of what you want and it can range from -50 to -100 at the beginning (even more). By first improving your relations, it can reach up to -50. Then you can try to get the obligations from them.

As you can see, I tried to persuade the states I had on Neutral by first improving relations and then I used the bankroll to get the bond. It was given that if a state was cheap to bankroll, I would start with that state – but there aren’t many of them.

For example, Brazil has a 12k bankroll so it is really important to think ahead when to play the bankroll correctly. Don’t pay others while you can and wait until the country you want to bankroll is at -60 to -50 before you start.

Are taxes the last way?

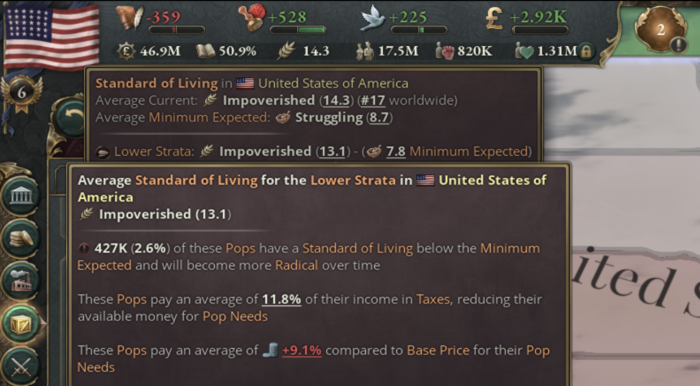

The first thing that may come to mind is to raise taxes or set up consumption taxes, but this is not the ideal way. By that you will get less income from your pops, as can be seen in the picture below where taxes affect the standard of living. So it makes more sense to optimize other paths than taxes. Raise taxes as a last resort.

If you have tried all the routes above and you really have nothing left to do but taxes, you can theoretically still try to reduce the cost of government or the cost of military salaries. For me, this is always the last path I choose because it affects relations with the parties.